Nations endorsing crypto even in winter - Stablecoins may be the starting point for regulations. Voyager and Celsius file for bankruptcy, Dubai is pushing ahead with crypto plans…

July 2022

Once a month our team summarizes here the market movements and what we have been following for our client and ourselves. We have hand-selected what we believe to be must-reads of this month to ensure you are all caught up on the most recent developments. Articles are grouped per region to facilitate your pick based on interest.

Stablecoins: The balancing act of innovation and regulation

According to the Bank of International Settlements and Financial Stability Board, stablecoins are asset-linked digital cryptocurrencies that aim to maintain a stable value relative to a specified asset, or a pool or basket of assets. Stablecoins are therefore types of digital money, but they differentiate themselves from traditional digital money (e.g. deposit accounts in banks) in that: 1) they are cryptographically secure, and 2) they are built on distributed ledger technologies standards. Stablecoins are also less volatile than traditional cryptocurrencies such as Bitcon and Ethereum thus proving a better alternative to cryptocurrencies in terms of payment methods. These features allow stablecoins to conduct almost instantaneous transactions on a 24x7 basis and help in speedy and cost-efficient cross border transactions.

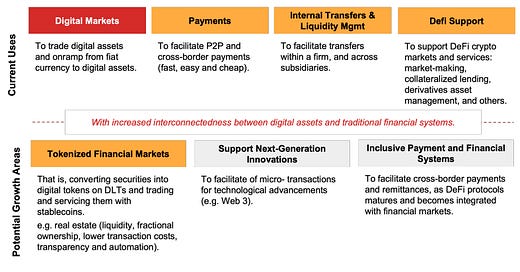

Figure 1: Overview of Current Uses of Stablecoins and Potential Growth Areas

Stablecoins can be broadly classified into 1) Fiat and commodity backed stablecoins, 2) Crypto-collateralized stablecoins, 3) Algorithmic stablecoins and 4) Institutional or private stablecoins depending on the protocol and assets used to back the stablecoin or it’s use cases.

The most widely used use case of stablecoins for now seem to be to trade digital assets by converting fiat currency into stablecoins, but as the industry is evolving the number of potential use cases seem to be growing as well such as using stablecoins to facilitate payments, DeFi services (such as lending, borrowing, staking, etc), asset tokenization and facilitate transactions on Web3.

Though stablecoins present a great opportunity and maybe a better alternative to traditional cryptocurrencies as means of payments, they are also exposed to the high volatility of the cryptocurrency industry. This was exemplified earlier this year with the crash of the Terra’s algorithmic stablecoin to basically zero and wiping over USD 40 billion from the market and this has led to a contagion effect on the broader market and has affected the prices of the other commodity or fiat backed stablecoins, with many not regaining their peg, as investors feared losing their investments.

To prevent such collapses from occurring and to help protect investors, regulators across the globe (including EU, Canada, USA) are working towards creating a set of standards and laws aimed to stabilize and reduce volatility of stablecoins. In the end, any regulatory framework should strike a balance between risk reduction and competition, innovation, pragmatism, and technological novelty.

For more details on stablecoins, we invite you to access this short document by Blockzero

REGION: NORTH AMERICA

Crypto bankruptcy plunges the industry into uncharted territory

[Protocol]

The recent turmoil in the crypto industry leading to billions of dollars being wiped out has created a turmoil amongst many prominent exchanges, funds and lenders in the industry resulting in bankruptcies and in many cases blocking of withdrawals of consumer funds. Two most prominent lenders in the industry Voyager and Celcius have now filed for bankruptcy after they had initially blocked withdrawals from customer accounts due to market volatility and crashing prices. Crypto lenders attracted deposits from customers by offering high interest rates and lent out the assets to borrowers, when the prices crashed and borrowers got liquidated, they were unable to pay back the lenders who in turn couldn’t repay customers. This would be the first time US courts have had to deal with large scale crypto bankruptcies and customers may lose most or all of their deposits if the court rules that the assets belong to the lender and could be pooled and used to repay creditors. The lack of regulations and high volatility in the assets along with contagion caused by the LUNA crash has left retail investors bearing the brunt of the failures or lack of internal controls.

https://www.coindesk.com/business/2022/07/13/celsius-starting-bankruptcy-proceedings-report/

https://www.protocol.com/fintech/crypto-bankruptcy-voyager-celsius

US Treasury Develops 'Framework' for International Crypto Regulation

[CoinDesk]

In response to President Biden's executive order on crypto to create a robust comprehensive framework, The U.S. Treasury Department on Thursday released a document on how it could potentially collaborate with international regulators on the crypto currency sector. The fact sheet provides insights into the framework’s policy objectives as laid out in the Executive Order that include reducing use of crypto for illicit financing activities, protecting investors and consumers, and promoting technological advancement. To support this work, the Treasury Department said the U.S. should hold "engagements" and other types of forums, the fact sheet said.

As cryptocurrency adoption and use is increasing across the world, there may be a requirement for regulators to step in and enforce certain requirements to help prevent fraud and illicit activities.

Increased digitization across the world has resulted in many economies looking to adopt blockchain and CBDC technologies. The USA may be trying to establish itself as a key player in the cryptocurrency and digital money sector by collaborating with international bodies to help establish regulations and encourage growth and innovation. It may be critical for the USA to remain relevant and ahead of competitors in this space to ensure the USD retains its position as the world reserve currency. With the US taking charge on a global front and collaborating with internal partners, a global framework on the cryptocurrency sector could be established in the coming years benefitting and protecting the users and investors across the world.

https://www.coindesk.com/policy/2022/07/07/us-treasury-develops-framework-for-international-crypto-regulation/

https://home.treasury.gov/news/press-releases/jy0854

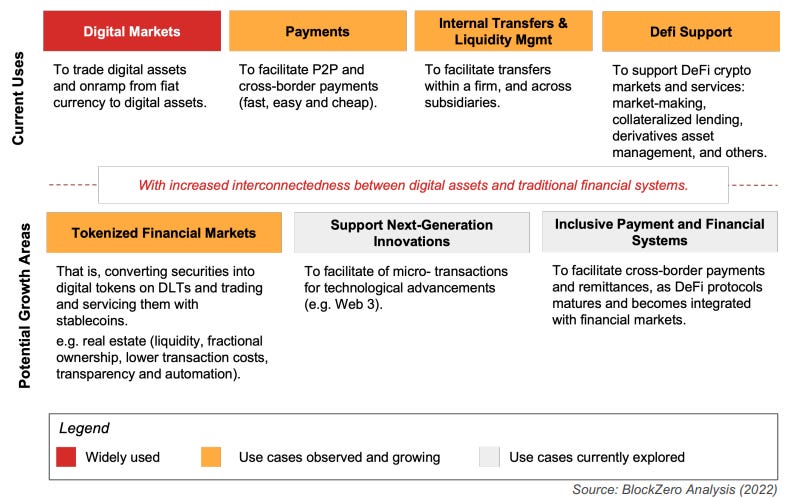

Two Thirds of commenters concerned about CBDC in USA

[CATO]

More than 66 percent of the 2,052 commenters were concerned or outright opposed to the idea of a CBDC (Central Bank Digital Currency) in the United States. The most common concerns were over financial privacy, financial oppression, and the risk of disintermediating the banking system. The Fed may be required to directly address, among other things, the public’s concerns regarding what a CBDC means for financial privacy and what unique benefit a CBDC will provide. As noted by the Republican members of the House Committee for Financial Services, led by Representative Patrick McHenry, “It is critical that we fully understand the potential impact a [CBDC] will have on Americans’ civil liberties and privacy rights before any legislative action is considered.” As it stands, the Fed has a long road ahead of it if it is to truly address these risks. The results of the survey seem similar to the survey done in Europe where the respondents raised similar concerns. It might help for the US Fed to spread awareness on the CBDC and quell the concerns of the citizens where possible.

Figure 2: Sentiment regarding the potential launch of a CBDC in the United States

https://www.cato.org/blog/update-two-thirds-commenters-concerned-about-cbdc

Bitt takes on CBDC team from Criteo, which had 12 central bank deals

[Ledger insights]

Image Source: Ledger Insights

Bitt, a leading CBDC software provider, announced that it was taking over the CBDC team of Criteo. Two of the Criteo CBDC team founders, James Shinn and Erik Bethel, are joining as Executive Director and Head of Business Development, respectively. Amongst other projects, Bitt is known for the DCash Eastern Caribbean digital currency project and Nigeria’s eNaira CBDC, which launched last October. Meanwhile, Criteo is a substantial company, but its primary business is in the ecommerce and marketing sectors. It entered Singapore’s Global CBDC Challenge last year and was one of the three winners, alongside big names in the sector, central bank provider Giesecke+Devrient and a joint project by ConsenSys and Visa. As a result of its win, Criteo signed a dozen central banks as clients. Jim Shinn said that Criteo is re-focusing on its core e-commerce business. This combined organization could be a strong contender for CBDC contracts world over.

https://www.ledgerinsights.com/bitt-takes-on-cbdc-team-from-criteo-which-had-12-central-bank-deals/

Congress Has Introduced 50 Digital Asset Bills Impacting Regulation, Blockchain, And CBDC Policy

[Urecomm]

The 118th Congress has reached a milestone of seeing 50 bills and resolutions that have been introduced so far which cover the crypto regulatory landscape in a variety of ways. In addition, the types of policy impacts that digital assets touch from foreign relations, monetary policy, consumer protection, and interpretations over how digital assets are considered, whether as securities or commodities for the industry, has broadened attention among a larger pool of policymakers. Combining multiple policy impacts with emerging technologies such as decentralized finance and NFTs, makes the exploration of new legislation for the industry a fascinating and complex path for D.C. policymakers. The 50 bills identified are broken into six different categories. The categories include crypto taxation, Central Bank Digital Currency (CBDC), crypto clarity on regulatory treatment of digital assets and digital asset securities, supporting blockchain technology, and issues of sanctions, ransomware, and implications involving either China or Russia’s use of blockchain or cryptocurrency, and access and limitations on use of crypto by U.S. elected officials. USA seems to have realized that digital assets are here to stay and are making significant progress in terms of regulations. Such robust regulations are required for crypto companies to set up base and flourish. Even though, USA is not claiming to be a global crypto hub, it seems to be taking the right steps by setting up the regulations.

https://urecomm.com/2022/07/03/congress-has-introduced-50-digital-asset-bills-impacting-regulation-blockchain-and-cbdc-policy/

REGION: EUROPE

ECB Says Bitcoin Ban "Probable" Due to Climate Concerns

[CryptoBriefing]

A new report published by the European Central Bank speculates that the EU parliament would also ban proof of work cryptocurrencies while making a decision on banning fossil fuel powered cars to help reduce greenhouse gas emissions and it’s impact on climate change. The report compares Proof of Work blockchains such as Bitcoin to fossil fuel cars while comparing Proof of Stake blockchains to Electric Vehicles. “Public authorities have the choice of incentivising the crypto version of the electric vehicle (Proof-of-Stake and its various blockchain consensus mechanisms) or to restrict or ban the crypto version of the fossil fuel car (Proof-of-Work blockchain consensus mechanisms),” the article states.

While it may be true that Proof of Work assets consume large amounts of electricity to run and complete transactions, it is in fact this feature that makes it secure, immutable and decentralized, thus ensuring no one party will ever have control over the blockchain and influence price or the transactions. Most Proof of Work (Bitcoin) miners are trying to reduce the environmental impact of mining by employing a higher mix of renewable energy and looking into other innovative ways to reduce carbon impact. Recently, Texas has welcomed Bitcoin miners to the state as they help stabilize the electricity grid and also have helped increase investment in renewable energy generation. A ban on Proof of Work blockchains without fully evaluating the benefits of such a system in terms of both innovation in renewable energy, and financial freedom and security may not be the right approach.

https://cryptobriefing.com/ecb-says-bitcoin-ban-probable-climate-concerns/

REGION: MEA

Dubai’s Metaverse Plan Targets 40,000 Virtual Jobs in Five Years

[Bloomberg]

Image Source: Angel Garcia/Bloomberg

Dubai, UAE has been actively adopting blockchain technology and cryptocurrencies to help drive the economy further and establish the country as a blockchain and Fintech hub in the middle east region. Now, Dubai is seeking to become one of the biggest metraverse economies by creating a strategy to add 40,000 jobs in the metaverse resulting in nearly USD 4 Bn added to the country's GDP.

Dubai aims to be a leader in setting and developing standards and regulations to develop safe and secure platforms which would help increase adoption of these new technologies. Dubai is already home to over 1,000 companies in the metaverse and blockchain sector, which contributes USD 500 million to the national economy, as per the article.

https://www.bloomberg.com/news/articles/2022-07-19/dubai-s-metaverse-plan-targets-40-000-virtual-jobs-in-five-years

Central African Republic launches national cryptocurrency called 'Sango Coin'

[The Block]

Image Source: The Block

The Central African Republic (CAR), the first African country to recognize Bitcoin as legal tender back in April, has now launched a national cryptocurrency called the “Sango Coin”. As part of Project Sango, the CAR will also look to tokenize its natural resource assets such as gold, petroleum, diamonds, copper, etc and use blockchain technology to digitize its land registry. The government will support crypto firms' access to natural resources such as gold, diamonds and uranium and institute a "citizenship by investment" program with zero-rate tax on income and businesses, according to the presentation. Though CAR is resource rich, it is one of the poorest countries in Africa and highly underdeveloped. The country plans to become a global crypto hub and with the help of blockchain technology attract private investments into the country by using tokens and blockchain infrastructure.

https://www.theblock.co/post/150041/central-african-republic-announces-plan-to-tokenize-countrys-minerals

https://www.theblock.co/post/155665/central-african-republic-launches-national-cryptocurrency-called-sango-coin

South Africa to regulate crypto as financial asset

[CoinTelegraph]

As the adoption and use of crypto currency is increasing and is nearly at 13% (according to research from global exchange Luno) of the population, South Africa is looking to regulate crypto currencies as financial assets. Currently, companies and individuals need to be registered as financial service providers and comply with regulations to provide any advice or intermediary services with regards to crypto. By introducing new regulations which will see cryptocurrencies fall under the scope of the Financial Intelligence Center Act (FICA), the country will be able to better monitor transactions for AML and reduce fraud or illicit activities, while protecting investors. As the global dominance of cryptocurrencies are increasing, regulators around the globe are speeding up the introduction of bills to monitor and create a regulatory framework for the sector.

https://cointelegraph.com/news/bitcoin-not-a-currency-south-africa-to-regulate-crypto-as-financial-asset

UAE Investors Enable Crypto Trading in Dirhams following Kraken and RAKBANK Partnership

[Blockchain News]

The UAE is looking to blockchain technology and cryptocurrencies to fuel the next phase of its growth, and has established regulatory frameworks for crypto products and services. RAKBANK (a local UAE bank) has partnered with Kraken to enable crypto trading in UAE Dirhams for Investors.

This move aims to help reduce costs in terms of using international correspondents for making money transfers into brokerage and trading accounts thus reducing forex and payment charges for customers. The move also aims to help reduce the time taken for settlement of funds especially with international cryptocurrency brokers, thus enabling traders to time their moves better and take advantage of market conditions.

https://blockchain-news.cdn.ampproject.org/c/s/blockchain.news/postamp?id=uae-investors-enable-crypto-trading-in-dirhams-following-kraken-and-rakbank-partnership.

IMF Warns Kenyan Central Bank Against Introducing a CBDC That Harms Fintechs and Banks

[Bitcoin.com]

The International Monetary Fund (IMF) has reportedly said the Kenyan central bank’s proposed digital currency should complement and not threaten the existing private sector digital money. The global lender insisted that if no safeguards are put in place, a digital currency issued by the Central Bank of Kenya (CBK) can potentially lower transaction costs to the point of driving out mobile money operators such as M-Pesa out of business. Other central banks may take note of this warning as they are in a rush to implement CBDC but an important step in the process is to ensure that existing payments systems are unaffected and function smoothly. The role of the CBDC is to complement and not to compete with existing payments systems.

https://news.bitcoin.com/report-imf-warns-kenyan-central-bank-against-introducing-a-cbdc-that-harms-fintechs-and-banks/

JAM-DEX... finally

[Jamaican Observer]

Image Source: JamaicaObserver

JAMAICA'S digital currency, JAM-DEX was launched on July 11 through the Lynk app, a digital wallet and currently the only transaction platform for Jamaicans to use the central bank digital currency (CBDC). As part of the launch the first 100,000 customers that signed up for JAM-DEX via the Lynk app were given an incentive bonus of USD 2,500 JAM-DEX in their wallets by the Government. To date, over 120,000 users have signed up on the platform and can now transact using Lynk e-money and now JAM-DEX to pay for goods and services with over 2300 merchants on the Lynk platform.

https://www.jamaicaobserver.com/business/jam-dex-finally/#:~:text=finally%20%2D%20Jamaica%20Observer&text=The%20long%2Danticipated%20JAM%2DDEX,Monday%2C%20July%2011%2C%202022.

Concerns Over Lost Fee Income Prompt Nigerian Lenders to Slow CBDC Adoption

[PYMNTS]

Central Bank of Nigeria Governor Godwin Emefiele said that Nigerian lenders have been putting up roadblocks against using e-Naira, Nigeria’s CBDC, concerned about loss of revenue from traditional banking services. The central bank has said only around 700,000 customers have made an e-Naira wallet since they debuted last year, though there are around 55 million bank accounts in the country, Bloomberg reported. Per the report, Emefiele said there was “apathy” at the banks, as banks feel that the e-Naira cuts down on banks’ work with mobile banking services to add more revenue. Emefiele also said the central bank was almost done with tests with MTN Group’s Nigeria unit to make a channel to allow Nigerians without bank accounts to open e-Naira wallets. Nigeria’s central bank seems to not have a cohesive CBDC strategy to take the banks into confidence and enable them to drive business models from the new monetary instrument. It may be crucial for other central banks to plan and strategize their CBDC project with a clear understanding of how other ecosystem participants will benefit and how to build structures to enable them to continue providing services.

https://www.pymnts.com/cbdc/2022/concerns-over-income-loss-prompt-nigerian-lenders-to-slow-cbdc-adoption/

REGION: APAC

Shanghai Plans to Cultivate USD 52 Billion Metaverse Industry by 2025

[CoinDesk]

Since the pandemic more individuals are not only working from home or destinations of their choice, every consumer activity has moved online to a greater extent. To take advantage of this trend more countries across the world are looking at the metaverse as the next step in increasing globalization and a new catalyst to grow and revitalize their economies.

The city of Shanghai has come up with plans to use the 5G technology and take advantage of the population's growing interest in NFT’s, cryptocurrencies and technology in general to cultivate a multi billion dollar metaverse industry.

This trend seems to be in line with many middle east and african economies (Central African Republic, United Arab Emirates, Nigeria, etc.) also turning to blockchain and crypto to increase economic activity and funding into their countries.

Image Source: CoinDesk/Bingham008/Unsplash

https://www.coindesk.com/business/2022/07/12/shanghai-plans-to-cultivate-52b-metaverse-industry-by-2025/

Reserve Bank of India (RBI) seeks to ban cryptos but India needs global support to make that effective

[Tomorrowmakers]

The Reserve Bank of India has called for the repeated prohibition and ban of use of cryptocurrency in India as it believes that crypto has a destabilizing effect in the monetary and fiscal policies of the country. India currently has over 250 million internet users own cryptocurrencies and ranks 1st amongst 26 countries in cryptocurrency ownership according to a survey conducted by Finder. The central bank believes that CBDC’s would be able to effectively replace cryptocurrency thus discouraging their use in the Indian economy and has previously raised concerns that high cryptocurrency usage in India could lead to the dollarization of the economy. The impact of banning cryptocurrencies in a country with one of the highest adoption and ownership rates would need to be analyzed as it may have implications throughout the industry.

The Finance ministry is taking a wait and watch approach stating that “any legislation for regulation or for banning can be effective only after significant international collaboration on evaluation of the risks and benefits and evolution of common taxonomy and standards.”

https://www.tomorrowmakers.com/personal-finance-news/rbi-seeks-ban-cryptos-india-needs-global-support-make-effective-fm-sitharaman-article

https://news.bitcoin.com/reserve-bank-of-india-is-working-on-phased-implementation-of-central-bank-digital-currency/

India's Crypto Industry Advocacy Body Disbanded

[CoinDesk]

The Internet and Mobile Association of India (IMAI) has disbanded The Blockchain and Crypto Assets Council (BACC), the only advocacy body representing the interests of India's crypto industry. The IMAI cited uncertainty over the regulations on the cryptocurrency sector and that it would like to use its limited resources on other digital initiatives that could provide more immediate contribution to a Digital India.

India has one of the highest cryptocurrency ownership and adoption in the world and the government rather than implementing a regulatory framework to help organize the sector, has taken strict measures such as increased taxes and now disbanding of the BACC, which seems to be counterintuitive especially when most economies across the globe are turning towards blockchain technology and cryptocurrencies for the next phase of economic development.

https://www.coindesk.com/policy/2022/07/14/policy-body-representing-indias-crypto-ecosystem-disbanded-sources/

https://www.coindesk.com/policy/2022/07/19/indian-exchanges-hold-meeting-to-discuss-way-forward-after-crypto-advocacy-body-is-dissolved-sources/

Central Bank Of Singapore to release Bitcoin, crypto regulation plan

[Bitcoin Magazine]

The Monetary Authority of Singapore (MAS) is set to release crypto regulation next month as the country plans to become a hub for digital assets and also prevent fraudulent and bad faith actors from shielding themselves behind the regulatory barriers in Singapore.

Many firms involved in the recent contagion events, such as Terraform labs (LUNA) and 3AC, which has led to a broad downturn in the cryptomarkets seem to have used regulatory barriers in Singapore to prevent themselves from international scrutiny and legal action, but in reality the MAS feels that many of these companies which claimed regulatory compliance within Singapore were either not correctly registered, not following MAS guidelines or proper licensing procedures, or altogether ceased management under MAS oversight prior to insolvency, according to the report.

The MAS aims to introduce stricter regulations to help protect consumer and investor interest while also helping these companies grow and prosper within the ecosystem.

https://bitcoinmagazine.com/markets/singapores-central-bank-to-release-bitcoin-crypto-regulation

China struggles to launch digital yuan after 8 years of trials

[News one Top]

Eight years after China first embarked on the path toward a digital yuan, the central bank’s pilot program for the digital yuan has been expanded to 23 cities covering nearly one-fifth of the population. But a full launch of the currency remains elusive as a population already used to mobile payments such as Alipay and WeChat Pay sees no reason to abandon their familiar apps. A PBOC task force began studying central bank digital currencies in 2014, and the pilot kicked off in October 2020 in Shenzhen. As of the end of last year, 216 million, or around 20% of China’s population, had created a digital wallet on the central bank’s app. The advantages of the CBDC over existing payments systems still have not been enough to convince the public to switch from their usual apps. The PBOC in its March meeting said it will need to work on the digital yuan’s convenience and innovation. A pioneer in the CBDC space, China seems to be struggling with adoption of the monetary instrument even with many new benefits to users. It is important for other central banks to be prudent and cautious before they decide to launch a CBDC. The central banks may need to have a clear plan supported by data to ensure adoption.

https://newsonetop.com/china-struggles-to-launch-digital-yuan-after-8-years-of-trials/

REGION: SOUTH AMERICA

Santander to Offer Cryptocurrency Services in Brazil in the Coming Months

[Bitcoin.com]

Image Source: Bitcoin.com

Santander, one of the biggest financial institutions in the world, serving more than 153 million customers, has announced plans to start offering cryptocurrency-based services to customers in Brazil. While the company is still working on a comprehensive and clear law framework for the asset class, many banks and fintech companies are considering offering cryptocurrency-related services due to the demand of their customers for these investment products. One of these institutions is Itau Unibanco, one of the largest banks in Brazil, which reported it was mulling the introduction of such products earlier this month. Banks may be looking at the revenues that they could make by entering into this space and leveraging their customer base. However, they may need to be cautious of the potential risks that are inherent to the crypto space. Is this a trend which can occur in other countries, we will have to wait and watch.

https://news.bitcoin.com/santander-to-offer-cryptocurrency-services-in-brazil-in-the-coming-months/

Brazilian Fintech PicPay to Launch Crypto Exchange, Real-Tied Stablecoin

[CoinDesk]

Crypto adoption in South America has been growing tremendously over the last few years with multiple service providers entering into the foray and also forcing established banks such as Santander to adopt crypto offerings in the fear of being left behind.

PicPay, a digital payments app has now planned to launch a crypto exchange and Brazilian-real based stable coin this year. PicPay has over 30 million active users, representing greater than 10% of the population and aims to take advantage of the growing cryptocurrency adoption in Brazil by integrating these new products to its already existing marketplace.

With more companies and countries adopting cryptocurrencies in Latin America, the crypto industry could see further innovation and growth in the coming years and increased regulation as a result.

https://www.coindesk.com/business/2022/07/12/brazilian-fintech-picpay-to-launch-crypto-exchange-real-tied-stablecoin/

Paraguayan Senate Passes Bill Regulating Crypto Mining and Trading

[CoinDesk]

The Paraguayan senate has passed a bill regulating crypto mining and trading. Companies that wish to operate in this space would require to apply for a license and get approval. The bill is now with the executive branch of the government before it becomes law.

The National Electricity Administration will be in charge of enabling the energy supply, and the Secretariat for the Prevention of Money or Asset Laundering will supervise the whole investment process carried out by crypto companies. The National Securities Commission will be in charge of the commercialization of the obtained assets. (As per the new article)

Paraguay produces almost all of its electricity using renewable hydroelectric energy and exports most of the electricity to neighboring countries. By encouraging crypto mining and monetizing electricity generation within the country, the government could expect more jobs, increased investment in infrastructure and create an entire new industry around crypto currencies enabling better economic development for the country.

https://www.coindesk.com/policy/2022/07/15/paraguayan-senate-passes-bill-regulating-crypto-mining-and-trading/

https://www.coindesk.com/business/2022/07/21/commons-foundation-signs-100mw-deal-for-crypto-mining-in-paraguay/

REGION: Global

Bitcoin miners sell their hodlings, and ASIC prices keep dropping — What’s next for the industry?

[Genius interactive]

Crypto companies are going belly up, and Bitcoin mining companies also appear to be taking on water faster than they can bail. Bloomberg recently reported that many industrial-size Bitcoin miners took on a significant amount of debt by leveraging their equipment and BTC as collateral for loans to either acquire additional gear or expand their operations.

According to the report, and data from Arcane Research, miners owe some USD 4 billion in loans and now that Bitcoin price trades near its 2017 all-time high, the trend of miners liquidating their BTC holdings at swing lows to cover capital costs and operational costs is expected to pick up speed. The troubles faced by miners are also having a knock- on-effect on ASICs and their pricing at major mining hardware merchants like Big Sky ASICs, ASIC Marketplace, Bitmain and Kaboomracks shows popular top and mid-tier ASIC miners selling up to 70% down from their all-time highs in the USD 10,000 to USD 18,000 range. Profitability is slipping toward all-time lows, interest rates are rising, energy prices are skyrocketing, and all indicators point towards a global recession. Plenty of miners signed hosting contracts, power purchasing agreements, and other operational agreements using 2021 profitability models, not factoring in the current conditions. Now that bull market conditions have flipped and the bear market is here, miners with higher costs and untenable debt are starting to liquidate their operations.

We may see a few acquisitions of mining companies that are not able to manage their cash flow effectively. It might be a good time for cash rich bitcoin mining companies to invest more and acquire other cash starved bitcoin mining companies or ASIC miners and increase production.

https://geniusinteractive.org/bitcoin-miners-sell-their-hodlings-and-asic-prices-keep-dropping-whats-next-for-the-industry/

OTHER READS

Prudential treatment of crypto asset exposures - second consultation

https://bis.org/bcbs/publ/d533.htm

International Securities Regulator IOSCO to Focus on Global DeFi, Crypto Rules

Global Financial Watchdog FSB to Propose Crypto Regulations in October

Bitcoin Mining Rig Prices Slump to Near 2-Year Lows Amid Celsius Bankruptcy

Bitcoin Mining electricity mix increased to 59.5% sustainable sources

US Senators Push Bill to Make Small Crypto Transactions Tax-Free

https://www.coindesk.com/policy/2022/07/26/us-senators-push-bill-to-make-small-crypto-transactions-tax-free/

SEC lists nine crypto tokens as securities following Coinbase insider trading charges

IMF: World Economic Forum 2022

https://www.imf.org/en/Publications/WEO/Issues/2022/04/19/world-economic-outlook-april-2022

US Treasury Opens Door for Public Comments on Biden’s Crypto Order

US Senate Republican Seeking Bipartisan Support for Stablecoin Oversight Effort

ECB: The optimal quantity of CBDC in a bank-based economy

https://www.ecb.europa.eu//pub/pdf/scpwps/ecb.wp2689~846e464fd8.en.pdf

WHO ARE WE:

BlockZero is a boutique consulting firm specializing in the evolution of the financial infrastructure through digital assets, digital currency, stablecoins and Central Bank Digital Currency (CBDC).

BlockZero advises global financial institutions, central banks and financial technology companies in the exploration, experimentation, technical implementation and rolling out of digital asset-based infrastructure.