DeFi and Regulation: Can they Coexist? - BlackRock to offer Bitcoin investing, Stablecoins recommendations for the European Union, Iran placing import orders using crypto …

August 2022 Newsletter

Once a month our team summarizes here the market movements and what we have been following for our client and ourselves. We have hand-selected what we believe to be must-reads of this month to ensure you are all caught up on the most recent developments. Articles are grouped per region to facilitate your pick based on interest. As per usual, we begin with our special topic of the month, this time relating to the events of Tornado Cash: Defi and Regulation: Can they Coexist?

DEFI AND REGULATION: CAN THEY COEXIST?

The month of August yet began again with another turmoil in the industry as the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned virtual currency mixer Tornado Cash in relation to the laundering of the “proceeds of cybercrimes, including those committed against victims in the United States.” The sanction, which initially also concerned 45 Ethereum addresses associated with Tornado Cash, impacted hundreds of people in the U.S. who have at one point or another received or traded funds via the mixer, has raised concerns from various digital rights and privacy advocacy groups, suggesting the U.S.’s approach goes against “human rights” and is unconstitutional. While to say the least, sanctioning illicit finance activities or actors facilitating such activities is of no surprise - particularly with President Biden’s Executive Order from earlier this year indicating increased resources being allocated to doing precisely that - the questions remain whether the sanction - as it took place - was intended to make a stance / harsh statement to attest of the seriousness of the U.S. government when it comes to using crypto for illicit activities, or was it simply due to a lack of alternative options, whether banning protocols like Tornado Cash is the right approach and even whether it is a sustainable approach should mixers, privacy coins or base-layers gain mainstream adoption?

While these remain open questions, we have selected a few reads on this hot topic with the associated links for you to delve further as you please!

U.S. TREASURY SANCTIONS NOTORIOUS VIRTUAL CURRENCY MIXER TORNADO CASH

[U.S. Department of Treasury + Times, Chain Analysis]

Last August 8th, the U.S. Department of the Treasury’s OFAC sanctioned the virtual currency mixer Tornado Cash, notably in response to the tool having been used by a North Korean hacker group sponsored by the Democratic People's Republic of Korea (DPRK), the Lazarus Groupe, to launder close to $455 millions. Used to launder over $7 billion worth of crypto-currency, the Tornado Cash application is considered by OFAC as “a significant threat to the national security” of the United States.

Tornado Cash is a blender “tool” (see next) based on the Ethereum blockchain, which helps crypto-currency owners to protect their anonymity while doing crypto transactions.

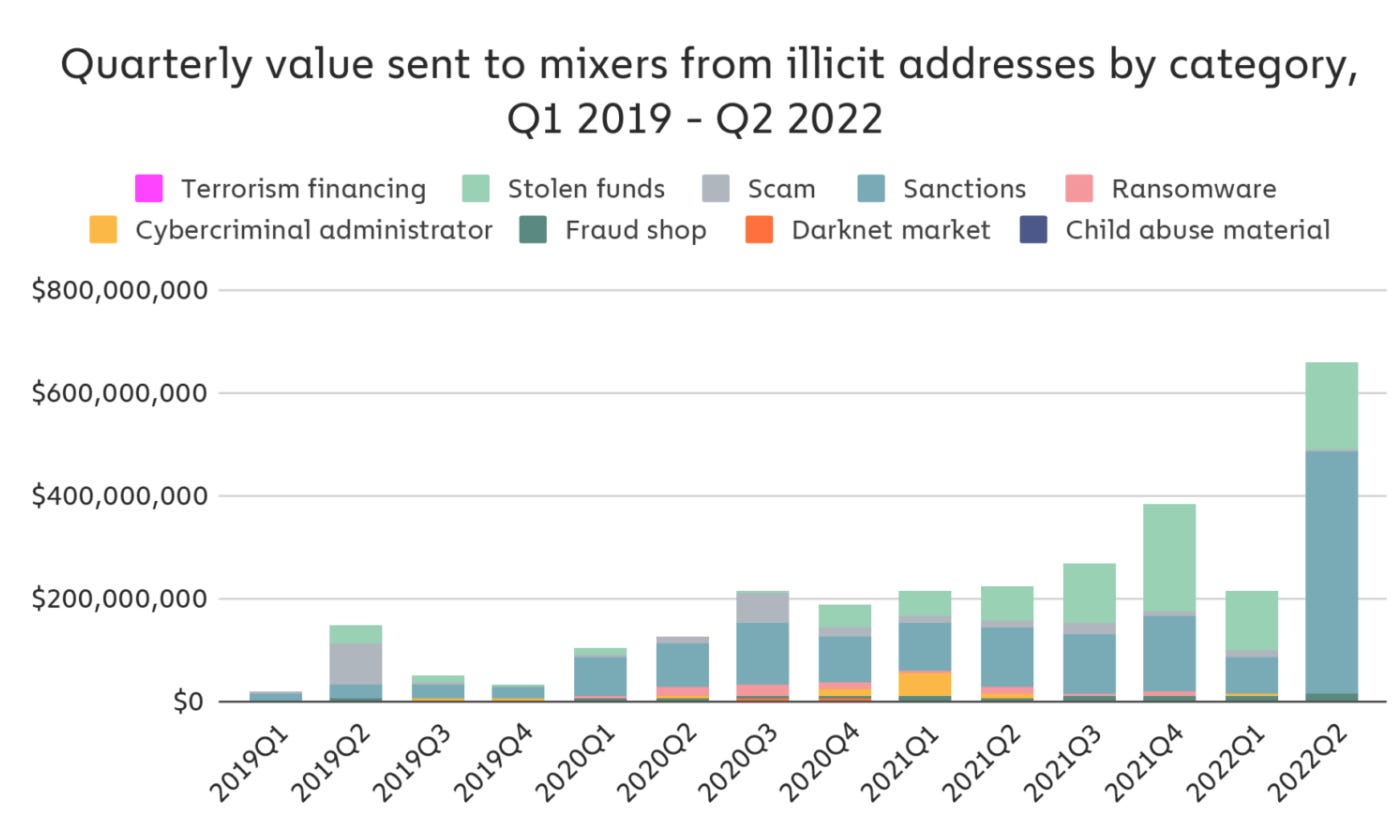

Yet, one cannot say this sanction comes as a surprise. In fact, a report published by Chainalysis indicated that addresses linked to illicit activities have transferred nearly 10% of their funds using crypto mixing applications.

Source: Chainalysis (2022)

In addition to listing Tornado Cash, Tornado Cash Classic and Tornado Cash Nova to the List of Specially Designated Nationals and Blocked Persons (SDN List) the OFAC maintains (on which Blender.io is also listed), 45 Ethereum addresses associated with Tornado Cash were also sanctioned. In fact, any American person or entity who interacts with those wallet addresses could face criminal penalties… But unfortunately, a user with mixed ETH from Tornado Cash distributed this ETH as a prank to hundreds of prominent addresses, effectively “air dropping” them a liability, and causing much caos….

In response to this “reckoning,” several DeFi protocols and dApps (e.g. AAVE) blocked addresses, including those who had been air dropped mixed ETH. Some ERC-20 token issuers and custodians offering redemption of USD stablecoin or fiat, including Circle (USDC) and UniSwap also responded similarly.

Treasury has explicitly noted it “will continue to investigate the use of mixers for illicit purposes and use its authorities to respond to illicit financing risks in the virtual currency ecosystem.” Increased scrutiny on the industry was to be expected in light of the regulatory reform underway. As prior (explicit) warning was apparently not given to Tornado Cash, this sanction might motivate other crypto firms, including mixers, to evaluate their business to see whether and how they might be violating the Anti Money Laundering act and legislations. However, risk now lies mostly in DeFi platforms, with more recent data from ChainAnalysis indicating that most major centralized exchanges have already begun to embrace AML/KYC as the interconnection between “traditional financial system” and that of digital assets is increasing.

https://time.com/6205143/tornado-cash-us-crypto-ban/

https://home.treasury.gov/news/press-releases/jy0916

https://blog.chainalysis.com/reports/crypto-mixer-criminal-volume-2022/

https://go.chainalysis.com/rs/503-FAP-074/images/Crypto-Crime-Report-2022.pdf

CRYPTO MIXERS AND PRIVACY COINS: CAN THEY RESIST CENSORSHIP?

[Blockworks]

Contrary to some beliefs, cryptocurrency transactions are not private by default. “Blockchain data is public [in a permissionless blockchain] and transactions are traceable.” And this is exactly why crypto mixers and privacy coins were created. In this article, Blockworks offers some baseline definitions contextualized to recent events to help you understand a bit better what crypto mixers are, how they work, how they differ from privacy coins, and ultimately what it means for the future of digital financial privacy.

Crypto mixers are a transaction mixing tool or service allowing users to “obscur a crypto wallet’s source of funds.” Tornado Cash is a “non-custodial” crypto mixer based on Ethereum, that uses non-custodial (i.e. no central entity taking full custody of the funds to mix) smart contracts to mix ETH and ERC-20 tokens. “Users send funds to smaart contract addresses that organize them by amount and effectively mix the deposits through a zero-knowledge proof contract.” The result is the equivalent of a withdrawal permission slip for each mixer that can be used to withdraw the “deposits.”

As the article explains, it would be nearly impossible for an outsider to correctly identify the source of funds, seeing only a myriad of potential options. But not impossible theoretically. One could use outside data and behavioral models to deduct the transaction history belonging to the tokens on the new wallet address. However, should there be an increase in adoption of mixers (or privacy coins), it would be “exponentially” more difficult to trace transactions, leading to greater resistance to censorship. Recall that bitcoin was in fact born as a result of the mistrust in traditional institutions following the 2008-2009 financial crisis. And the right to privacy remains an important concern in an era of increased digitization.

Another point raised worth noting is that the Tornado Cash application is an open-source smart contract on Ethereum blockchain. “The smart contracts will exist as long as the Ethereum blockchain continues to operate. So even though the Tornado Cash website is down, anyone can spin up a new front end - or interface with the smart contracts directly - that lets the users access the same mixers.”

Exactly how this story will roll-out is unknown. The application is not an entity, and as such provides no means to petition OFAC for sanction removal. Certainly not all people affiliated with the smart contract addresses are guilty. If this certainly points towards the need for crypto investors and consumers to be informed of the laws and regulations and risks associated with various crypto tools and assets, particularly if they could be considered hostile to U.S. interests, the approach taken by Treasury has likely left a divide and fed the mistrust in institutions for those who already did not have trust.

Other solutions likely exist. Michael Shaulov, CEO of Fireblocks - a digital asset custody, transfer and settlement platform - suggested “increased intelligence sharing between all related parties, such as Tornado Cash, Uniswap and the Treasury, who could then programmatically blacklist all wallets belonging to terrorists” as an example.

https://blockworks.co/defi-web-apps-block-users-hit-by-tornado-cash-dust-attack/

https://blockworks.co/crypto-mixers-and-privacy-coins-can-they-resist-censorship/

Other related links:

FBI Asks DeFi Platforms to Increase Security Measures, Warns Crypto Investors Against Vulnerabilities: https://www.ic3.gov/Media/Y2022/PSA220829 (August 29)

https://www.bloomberg.com/news/newsletters/2022-09-01/makerdao-gets-existential-after-tornado-cash-ban (September 1st)

https://complyadvantage.com/insights/cryptocurrency-regulations-around-world/ (last updated August 25)

REGION: NORTH AMERICA

BlackRock Offers Bitcoin Investing to Big Institutional Clients

[Bloomberg]

The world's largest asset management firm, BlackRock, has made a partnership with the crypto exchange Coinbase to allow its institutional investors to have direct access to crypto assets. This partnership aims to provide better exposure to crypto products for BlackRock's institutional clients, but also to focus on how to effectively manage these assets throughout their life cycle.

BlackRock is not the first institutional financial company to partner with a player from the crypto ecosystem. JP Morgan partnered with Decentraland to open their lounge in Decentraland’s virtual world in February 2022, while HSBC partnered with Sandbox in March 2022. Goldman Sachs also partnered with a crypto merchant bank, Galaxy Digital, to offer over-the-counter crypto trading services. Availability and access to crypto products for institutional investors to the digital asset ecosystem can significantly enhance adoption of these assets as such investors have access to capital from multiple sources and may be willing to take risky investments. Importantly, these strategic partnerships are allowing for greater trust to be built around digital assets product offering and services. The due diligence process that comes from the traditional or legacy players are necessarily encouraging greater informed decisions to be made, while also setting standards across the crypto investment value chain, notably in terms of risk management.

https://www.bloomberg.com/news/articles/2022-08-11/blackrock-offers-bitcoin-investing-to-big-institutional-clients

Canadian regulatory council creates new pre registration filing for crypto platforms

[CoinTelegraph]

As to ensure greater investor protection, the Canadian Securities Administrators (CSA), the council of the securities regulators of Canada’s provinces and territories, has begun to request crypto exchanges to file an undertaking commitment for the protection of their customers and investors while their registration is pending. As of now, two platforms have already complied with those undertakings, including Crypto.com and Coinsquare Capital Markets.

This is of no surprise considering the turmoil of the last few months, Terra's crash and Celsius’ collapse included, the recent reports that support what was already known, that is, the lack of financial literacy and appreciation of the risks related to crypto by the majority of crypto investors, and the ultimate role of regulators. As we see countries globally clarifying their position with regards to crypto, a handful of them either fully embracing or restricting if not banning their use, regulators in Canada and in most of the world are rather specifying the way to regulate and the regulations that should apply to the industry. As discussed in our latest thought leadership on Stablecoins: Stablecoins: The Balancing Act between Innovation and Regulation (see link below). This largely implies leveraging existing regulations to regulate the crypto ecosystem. Greater scrutiny (and related sanctions) is necessarily also to be expected - as seen with Tornado Cash.

However, as pointed out by CoinTelegraph, crypto exchanges in Canada currently face “lengthy waits for registration,” which in turn can have material impact on some of the players. As regulators tighten regulations around the sector, they should do so without detering innovation. Allowing them to continue to operate while they await does help, but it comes with uncertainty and costs that not all players will necessarily have the strength to face.

https://cointelegraph.com/news/canadian-regulatory-council-creates-new-preregistration-filing-for-crypto-platforms

https://www.blockzero.ca/_files/ugd/4c1936_b3567d9681d54c76815317129a6f83c3.pdf

https://www.securities-administrators.ca/news/canadian-securities-regulators-expect-commitments-from-crypto-trading-platforms-pursuing-registration/

REGION: EUROPE

Stablecoins - An Introduction and Recommendations for the European Union

[Digital Euro Association]

The Private Digital Euro Working Group of the Digital Euro Association (DEA), a think tank specializing in central bank digital currencies (CBDCs), stablecoins, crypto assets, and other forms of digital money issued a paper on stablecoins, particularly focusing on the various considerations of a Euro stablecoins. As duly noted in their foreword, “the level of confusion around stablecoins has only increased [in light of the recent Terra UST de-pegging earlier this year] as policymakers, regulators and market participants navigate their way into the new era.” Their paper offers an introduction to stablecoins that remains needed (and aligns with what we published last month), and presents a detailed, yet succinct presentation of the relevance of stablecoins for commercial banks, key uses cases and their unique value proposition - with a focus on the programmability that stems from their digital nature and the fact that they are typically built on DLT (distributed ledger technology).

An interesting angle explored, that is often not so openly discussed, is the interactions between stablecoins and CBDC (section 3). As they are likely to coexist in the near future (not just in Europe - although it is the focus of the paper), the authors argue that while there will necessarily be dimensions where CBDC and stablecoin would compete, in other situations, “both types of money will necessarily have to interact.” Hence the importance of anticipating these scenarios “to facilitate their respective positioning and design advanced interactions.” The three levels of interoperability explored are the use of digital euro as a backing for stablecoins, facilitating the direct exchange between euro stablecoins and a digital euro and establishing a common payment regime for greater interoperability with the payment ecosystem.

The need for an internationally coordinated approach is re-emphasized - outlining how much has yet to be resolved - from harmonizing regulation and guidance on tax treatment of transactions to clarifying rights and obligations that result from different design and claim structure… Lack of doing so could lead to regulatory arbitrage rather than fair trade and global growth. The authors offer a list of near-term tangible next steps - relevant for regulatory bodies globally.

A special attention is directed towards the need to promote public education; while their recommendation is specific for stablecoins, this is absolutely needed for the broader crypto asset ecosystem as part of a broader strategy to protect consumers and investors who must be equipped to make informed decisions.

https://medium.com/@digital_euro_association/stablecoins-an-introduction-and-recommendations-for-the-eu-from-the-private-digital-euro-working-155d23bedb99

Revolut receives nod from Cyprus regulator to offer crypto services

[CoinDesk]

Digital bank Revolut has obtained approval from the Cyprus Securities and Exchange Commission (CYSEC) allowing it to offer crypto services across the European Economic Area (EEA).

While crypto adoption in Europe is around 17%, which is similar to other developed nations, but lower than the global average of 22%, it is expected that this number would grow in the coming years especially post the EU MiCA bill which is designed to provide greater consumer protection and reduce financial crime in the crypto industry.

Revolut, is the the first entity to receive approval as a crypto-asset service provider from the Cyprus regulator, the company reported. And, this will enable it to provide crypto services to its 17 million customers in the European Economic Area.

https://www.coindesk.com/business/2022/08/15/revolut-receives-nod-from-cyprus-regulator-to-offer-crypto-services/

Crypto exchange Coinify obtains regulatory approval to operate in Italy

[CoinDesk]

Ahead of the passing of the EU's Markets in Crypto-Assets regulation, or MiCA bill, crypto firms are looking to gain regulatory approval and regulated status to ensure they will be allowed to offer crypto services once the bill is passed.

Continuing the trend similar to other crypto exchanges,such as Binance in May 2022, Coinfy has obtained approval to operate in Italy. While Italy’s crypto adoption is still growing and is currently ranked 10th in a poll conducted by Finder, the country is allocating more resources to the Blockchain sector which may result in increased interest and adoption for the industry.

https://www.coindesk.com/policy/2022/08/15/crypto-exchange-coinify-obtains-regulatory-approval-to-operate-in-italy/

Banks holding crypto could be capped by new EU ruling

[Payment Expert]

The lawmakers of the European Green Party are proposing a bill to impose hefty capital requirements on banks to limit their exposure to risky and volatile crypto assets and prevent a 2008 like financial crisis, while protecting consumers.

Under the proposed bill, crypto assets like Bitcoin will be classified as volatile and risky under Class 2 and a bank may only have 1% of its Tier 1 capital in such assets, whereas there would not be any caps for Class 1 assets which are more stable such as stablecoins and DLT based securities and banks may have more flexible capital requirements.

By limiting exposure, banks could still hold crypto assets on their balance sheet while still preventing a collapse like we have seen recently with various crypto lenders in the market.

https://paymentexpert.com/2022/08/18/banks-holding-crypto-could-be-capped-by-new-eu-ruling/

REGION: MEA

South Africa's Central Bank greenlights financial institutions to serve crypto clients

[CoinDesk]

Financial institutions in South Africa will now be able to process funds linked to crypto-currencies and will not have to indiscriminately block customers who invest in crypto-currencies. The new central bank guidelines imply that financial institutions will be able to act as a conduit for funds that are linked to crypto exchanges. This will therefore allow investors easier access to the digital asset ecosystem and promote financial sector innovation.

In the past, some South African banks had closed customer accounts (i.e. de-risking strategy) that were linked with crypto exchanges citing the risk exposure for the banks to money laundering, terrorist financing and proliferation financing (ML/TF/PF). The South African Reserve Bank (SARB) is now recognizing that the best policy is to mitigate and manage such risks through a comprehensive ML/TF/PF risk assessment instead of the blunt and inefficient de-risking strategy previously utilized by the banks. It is a move in the positive direction for crypto firms, especially in these trying times. Given the role of central banks globally and some of their common concerns regarding crypto, such a move by the SARB may help others embrace change responsibly, with a comprehensive, risk management strategy.

https://www.coindesk.com/policy/2022/08/19/south-africas-monetary-authority-greenlights-banks-to-serve-crypto-clients/

CBN announces USSD code for eNaira, 10 months launch

[Ripples Nigeria]

The Unstructured Supplementary Service Data (USSD) code for the eNaira is *997#, according to the Central Bank of Nigeria (CBN). The USSD code was announced 10 months after the unveiling of the eNiara. CBN said the *997# eNaira USSD code would enhance diaspora remittances, enable direct welfare disbursements to citizens, as well as improve the availability of central bank money, all of which are to improve financial inclusion. The eNaira solution was built by Bitt, a leading CBDC (Central Bank Digital Currency) solution provider.

Ripples Nigeria had reported that the eNaira recorded 840,000 downloads since it was launched in October 25, 2021, and has recorded 4 billion transactions across the 270,000 active wallets comprising 252,000 consumer wallets and 17,000 merchant wallets. The CBN is betting on the 81 million Nigerian adults using mobile phones, and 150 million mobile subscribers, for the successful adoption of the eNaira.

Is the USSD code enough to promote adoption of the digital currency in the country? We will have to wait and see the results but it may require a lot more than only USSD to promote adoption. China even with all the advancements in its CBDC solution seems to be facing issues with adoption goals (as noted in our July newsletter). In order to ensure adoption at scale, central banks must carefully plan the launch of a CBDC, from the strategy to the design, the pilot and all the way to the full deployment.

https://www.ripplesnigeria.com/cbn-announces-ussd-code-for-enaira-10-months-launch/

Iran Places First Import Order Using Crypto-currency, Could Help Dodge US Sanctions

[KarKey]

Iran made its first official import order using crypto-currency in August 2022, the semi-official Tasnim agency, a move that could enable the Islamic Republic to circumvent US sanctions that have crippled the economy. The order, worth USD 10 million, was a first step towards allowing the country to trade through digital assets that bypass the dollar-dominated global financial system and to trade with other countries similarly limited by US sanctions, such as Russia. The agency didn’t specify which crypto-currency was used in the transaction.“By the end of September, the use of crypto-currencies and smart contracts will be widely used in foreign trade with target countries,” an official from the Ministry of Industry, Mine and Trade said on Twitter.

The US imposes an almost total economic embargo on Iran, including a ban on all imports including those from the country’s oil, banking and shipping sectors. Last year, a study found that 4.5 percent of all Bitcoin mining was taking place in Iran, partly as a result of the country’s cheap electricity. The mining of crypto-currency could help Iran earn hundreds of millions of dollars that can be used to buy imports and lessen the impact of sanctions. Circumventing sanctions could enable any rogue nation to operate without any penalty from any other nation. In such situations, nations lose the power to control flow of capital to and from such nations. Digital currencies seem to be like a double-edged sword in this case.

It is worth mentioning that Iran has been using this strategy for some time now. That is, selling cheap oil (converted into electricity) for bitcoins that are then used to buy imports. However, this announcement is the first one from a government official, and arguably could be part of a political strategy in the tug of war between the US and Iran. As fascinating (or not) that this quarrel could be, what is interesting is how blatantly Iranians have been successfully trading bitcoins for dollars in the last 4 to 5 years (otherwise why keep mining).

As traditional financial services become increasingly interconnected with the crypto industry, this implies that: 1) many financial institutions could be working second hand with bitcoins originated in Iran (which not a hard sanction, but could create problems), or 2) could be getting into bitcoin transactions with Iranian nationals or entities (which is serious), and 3) many exchanges and crypto services are not implementing adequate KYC policies (e.g. Kraken), which opens the door to these contaminated bitcoins to go around otherwise compliant institutions unbeknownst to them.

As illustrated by the recent Tornado Cash sanctions and the Kraken investigation, the U.S. government is not likely to sit idle. This may therefore be a time to be worried about the origin of crypto assets.

https://karkey.in/iran-places-first-import-order-using-cryptocurrency-could-help-dodge-us-sanctions/

https://ciphertrace.com/sanctions-research-more-than-72000-unique-iranian-ip-addresses-linked-to-more-than-4-5-million-unique-bitcoin-addresses/

REGION: APAC

China sweeps up 12,000 crypto-related social media accounts in fresh clean-up campaign targeting banned digital assets

[SCMP]

Chinese authorities are targeting online discussions and the promotion of crypto-currencies, the country’s internet regulator said, in a new campaign launched since banning the trading of digital assets last year. The Cyberspace Administration of China (CAC) has ordered social media platforms to terminate 12,000 crypto-currency-related accounts across Weibo, Baidu, WeChat, and other websites. Nearly a thousand of these accounts had been “guiding” internet users to invest in crypto-currencies “in the name of financial innovation and blockchain”.

The latest crackdown is part of a new campaign the CAC launched recently targeting the “chaos” of crypto-currency speculation, the watchdog said, as netizens who were “confused by” the false promise of high returns have suffered heavy losses from crypto-currency trading activities. The move by the CAC could be viewed in the context of protecting investor interest. Due to the high return proposition of the crypto market, investors need to be communicated of the high risk also involved. Yet, the issue goes beyond the lack of adequate information for crypto consumers and investors to make informed decisions, but also misinformation. In line with this, the AMF (L'Autorité des marchés financiers, regulator in Québec, Canada) launched a campaign earlier this year to that effect, which was broadcasted on the local radio, aiming to raise awareness of false promises regarding crypto and re-directed them to the AMF website for more information on the subject.

Regulators globally could take cognizance of this move and consider regulating the information on crypto disseminated in social media as this may be the medium of information for many.

https://www.scmp.com/tech/policy/article/3188280/china-sweeps-12000-crypto-related-social-media-accounts-fresh-clean

https://lautorite.qc.ca/grand-public/investissements/les-cryptos

Seven S. Korean Brokerages Plan to Start Crypto Exchanges Next Year: Report

[CoinDesk]

Seven large traditional brokerages which include the likes of Mirae Asset Securities and Samsung Securities in South Korea have started laying the groundwork for their own crypto exchanges in the first half of next year. The firms have applied for preliminary approval and establishment of corporations to run virtual asset exchanges, the report said.

South Korean President Yoon Suk-Yeol took office in May and had promised to be more friendly to the crypto industry and nurture new projects. The fact that big traditional firms are looking to enter crypto is in line with Yoon's easing of regulations. Traditional players may be viewing the market opportunities and the pro-crypto regulations to enter the space. Regulators and the country’s leadership may play a key role in shaping the future of crypto in the region.

https://www.coindesk.com/business/2022/08/22/seven-s-korean-brokerages-plan-to-start-crypto-exchanges-next-year-report/

China’s Ant Group partners with Malaysian investment bank Kenanga to launch ‘SuperApp’

[TheBlock]

Malaysia’s largest independent investment bank Kenanga announced that it is partnering with China’s technology powerhouse, Ant Group, to launch a wealth generation and management “SuperApp.” Kenanga has almost 50 years of retail experience serving over half a million customers. The “SuperApp” will feature a suite of financial solutions, such as stock trading, digital investment management, foreign currency exchange and crypto trading. It is interesting to note that Ant group, a chinese entity, is involved in developing an app that supports crypto trading outside China.

Could this be taken as a case as to how crypto innovation will migrate to other countries if crypto bans are imposed - only time will tell. However, given the growing number of nations whose main trading partner is China, such expansion of China’s presence through the ‘export’ of Chinese digital asset infrastructure seems likely over time as it would clearly benefit China.

https://www.theblock.co/post/165456/chinas-ant-group-partners-with-malaysian-investment-bank-kenanga-to-launch-superapp

India presses ahead with CBDC pilot run on wholesale business

[Coin Geek]

The Reserve Bank of India (RBI) has revealed further details of its central bank digital currency (CBDC) rollout plans. According to a report by Business Standard, the pilot testing of the digital rupee will kick-off as planned in the 2022-2023 fiscal year but will only be introduced to wholesale businesses. Citing sources familiar with the development, the news outlet noted that the CBDC’s design will not allow for the anonymity of the test participants. “The Reserve Bank of India (RBI) is planning to introduce its Central Bank Digital Currency this fiscal year in a phased manner, initially for use only by wholesale businesses, and is designing it in a way that leaves no room for anonymity by its users,” a source told the news outlet.

The report added that the CBDC will only be introduced to retail segments after the RBI has finished assessing its performance with the wholesale businesses. Like several other central banks, the RBI has been contemplating the level of privacy its sovereign-backed digital currency should have. In an interview back in April, RBI Deputy Governor T Rabi Sankar said that the digital rupee is likely to allow for “low-value transactions” to remain anonymous.

This is a conundrum faced by Central Banks globally on how to balance privacy vs. monitoring of CBDCs. It will require a delicate balance between both and will need to consider a number of factors including some of which are very local.

https://coingeek.com/india-presses-ahead-with-cbdc-pilot-run-on-wholesale-business/

REGION: SOUTH AMERICA

Argentina Ethereum Conference Highlights Crypto’s Growing Reach in the Country

[CoinDesk]

The country continues to serve as a hotbed of crypto innovation drawing 4,000+ people even as it faces its latest financial crisis - July inflation had reached a whopping 7.4%, the highest monthly rate in 20 years. “The hackathons and crypto gatherings in this place were the origin of birth to the teams and individuals that have built this beautiful community,” Ethereum Foundation Executive Director Aya Miyaguchi said.

Since mid-2019, Argentina has been living through a financial crisis that has led to high inflation and a devaluation process that took the Argentine peso from 40 to the U.S. dollar in August 2019 to 350 in July 2022.

Crypto growing in popularity is logical, given how younger generations watched their parents suffer because of government mismanagement (and high corruption!). Currently, the Argentine government's foreign exchange restrictions prevent locals from buying more than $200 per month in commercial banks, although Argentinians can access foreign currency in brokerage houses or stablecoins in crypto exchanges. The volatile nature of the currency and the inability to purchase foreign exchange may create a rising trend for residents of Argentina to adopt crypto currency. A recent survey by Opinaia y Muchnik suggested that three out of four argentinians would purchase cryptocurrency to invest, or as a way of preserving buying power (i.e. argentinian-inflation insensitive). Yet, the same survey indicated a knowledge gap in about 38% of the survey respondents when it came to the understanding of the operation and the inner workings of crypto assets.

The regulator may have to play a key role here to protect the residents’ interests and ensure the information on crypto and risks is communicated adequately.

Source: Twitter

https://www.coindesk.com/business/2022/08/16/argentina-ethereum-conference-highlights-cryptos-growing-reach-in-the-country/

https://news.bitcoin.com/survey-almost-three-out-of-four-argentinians-are-willing-to-purchase-crypto-for-investing-or-saving-purposes/

Mercado Libre Launches Its Own Ethereum Cashback Token

[Decrypt]

Brazil, the largest and most populous nation in South America also has a rate of crypto-currency ownership amongst its population with nearly 5% or 10 million people owning crypto-currencies. This adoption is expected to grow even further when the Crypto Regulation Bill approved by the Senate Committee on Economic Affairs awaits a fall vote on the Senate floor.

In order to take advantage of the growing popularity and increased use of crypto-currencies in the country, Mercado Libre, the country’s largest e-commerce company has rolled out its own crypto-currency the Mercado Coin, an ERC-20 token developed on the ethereum blockchain. The coin can be used to make purchases and receive cashbacks/discounts on the MercadoLibre website and will be available to its 80 million users in Brazil.

This is an interesting case of using crypto as an integral part of a company's business model, rather than as a speculation or means to raise funds.The cashbacks/discounts could attract customers to buy the mercado coin, thus ensuring excess free cash to the company on any unused mercado coin balances and also helping with return customers who would like to take advantage of the deal thus ensuring customer stickiness.

Mercado Coin will be tradable on Mercado Pago, the company's digital wallet, at an initial price of 10 cents, which will be subject to market conditions, the company said.

https://decrypt.co/107774/mercado-libre-launches-its-very-own-cashback-cryptocurrency

https://www.coindesk.com/business/2022/08/18/e-commerce-giant-mercadolibre-introduces-cryptocurrency-in-brazil-plans-wider-latin-america-use/

https://triple-a.io/crypto-ownership-brazil/

ENOUGH OF INTENSE NEWS… SOMETHING LIGHT ;)

REGION: Global

More Than Half Of All Bitcoin Trades Are Fake

[Forbes]

A new Forbes analysis of 157 crypto exchanges finds that 51% of the daily bitcoin trading volume being reported is likely bogus. One of the most common criticisms of bitcoin is pervasive wash trading (a form of fake volume) and poor surveillance across exchanges. The U.S. Commodity Futures Trading Commission defines wash trading as “entering into, or purporting to enter into, transactions to give the appearance that purchases and sales have been made, without incurring market risk or changing the trader's market position.” The reason why some traders engage in wash trading is to inflate the trading volume of an asset to give the appearance of rising popularity. In some cases trading bots execute these wash trades in tokens, increasing volume, while at the same time insiders reinforce the activity with bullish remarks, driving up the price in what is effectively a pump and dump scheme. Wash trading also benefits exchanges because it allows them to appear to have more volume than they actually do, potentially encouraging more legitimate trading.

There is no universally accepted method of calculating bitcoin daily volume, even among the industry’s most reputable research firms. For instance, as of writing the Forbes article, CoinMarketCap puts the latest 24-hour trading of bitcoin at $32 billion, CoinGecko at $27 billion, Nomics at $57 billion and Messari at $5 billion. Could a trustworthy global international player play the role of watchdog to report on the volumes? Or could we take inspiration from the traditional finance space and adopt their methods to this space?

https://www.forbes.com/sites/javierpaz/2022/08/26/more-than-half-of-all-bitcoin-trades-are-fake/?sh=64134ee26681

Futurist Conference:

Last month the Blockchain futurist conference was held in Toronto on August 9-10, the two day event attracted some of the biggest and most influential names in the blockchain and crypto industry in Canada and internationally.

The conference held over two days, discussed various current topics such as regulations in DeFi, sustainability, privacy and the future of the industry such as Web3 and metaverse. While most of the large conferences at the event primarily focussed on educating newcomers to the industry on the basics of blockchain such as NFT’s, wallets, privacy to develop an understanding of the use cases of blockchain and its advantages, we’d argue that most of the learning took place on smaller stages where one could find interesting presentations of use cases and discussions. We have summarized the themes from the conference as a quick read.

OTHER READS

Digital Currency Group registers to lobby for the first time: https://www.theblock.co/post/163862/digital-currency-group-registers-to-lobby-for-the-first-time

Crypto Exchange Gemini Introduces Staking Support for US Investors: https://www.coindesk.com/business/2022/08/18/crypto-exchange-gemini-introduces-staking-support-for-us-investors/

Bank of Canada: Cash, COVID-19 and the Prospects for a Canadian Digital Dollar: https://www.bankofcanada.ca/2022/08/staff-discussion-paper-2022-17/

Crypto Exchange Binance Receives Preliminary Approval to Operate in Kazakhstan: https://www.coindesk.com/policy/2022/08/15/crypto-exchange-binance-receives-in-principle-approval-to-operate-in-kazakhstan/

Department of Finance, Shengxiang Business School, Sanda University, Shanghai, China: Research on factors affecting people’s intention to use digital currency: Empirical evidence from China (2022): https://www.frontiersin.org/articles/10.3389/fpsyg.2022.928735/full

Nigeria: Hackathon – CBN, AFF to Assist 10 Startups to Increase eNaira Adoption: https://regtechafrica.com/nigeria-hackathon-cbn-aff-to-assist-10-startups-to-increase-enaira-adoption/

Invesco launches metaverse fund: Citywire: https://www.theblock.co/post/164785/invesco-launches-metaverse-fund-citywire

WHO ARE WE:

BlockZero is a boutique consulting firm specializing in the evolution of the financial infrastructure through digital assets, digital currency, stablecoins and Central Bank Digital Currency (CBDC).

BlockZero advises global financial institutions, central banks and financial technology companies in the exploration, experimentation, technical implementation and rolling out of digital asset-based infrastructure.